Qualified Opportunity Zone

The Federal Tax Act of 2017 established a set of tax incentives to encourage expanded investments in “economically distressed” regions. Such areas are each designated as Qualified Opportunity Zones (“QOZ”) for Opportunity Zone Investment (“OIZ”). The First Keystone Industrial Park, in Reeves County, Texas, qualifies since it is located within a QOZ. These tax-driven incentives require that investment funds must come from recent asset sales that generate capital gains. An investment in QOZ assets enables exemption from any tax on the capital gains on the investment if held for 10 or more years. Here is how it works:

Qualifying Assets:

Capital Gains from the recent sale of an asset must be invested in a QOZ (“Asset”) within 180 days of the disposition of the property. It can be a building, fixtures and/or equipment. The Asset must be new or an improvement to a pre-existing asset. Not eligible are already in-service facilities (unless improvements of greater than 90% in value are made to the existing facilities).

From First Keystone, virtually anything that we build and deliver in our industrial park, provided that it is a first-time use, qualifies. Once an asset in a QOZ has been placed into service, it no longer qualifies. Thus, buildings already occupied and in use do not qualify. Check out our Pecos industrial property to buy.

Recap of the Opportunity Zone Benefits:

- Forgiveness of gains due to appreciation on the new investment Asset.

- Primary benefit.

- Permanent exclusion of tax on any capital gain upon the sale of the Asset if held for least 10 years. (This feature is called “step-up in basis”.) Thus, the gains from the sale of the investment in a QOZ are free of tax liability.

- Deferral of Recent Capital Gains

- A secondary benefit.

- The funds used to acquire the Asset must be from a capital gain generated in the last 180 days before the Asset was acquired. (There are exceptions.)

- OIZ investments enable the owner to defer the payment of tax owed on a capital gain and/or qualified 1231 gains until 2026 (but only gains that would be recognized for federal tax proposes before Jan 1, 2027). The amount of deferred capital gains that is subject to this provision is limited to the amount of that gain invested in the OIZ Asset.

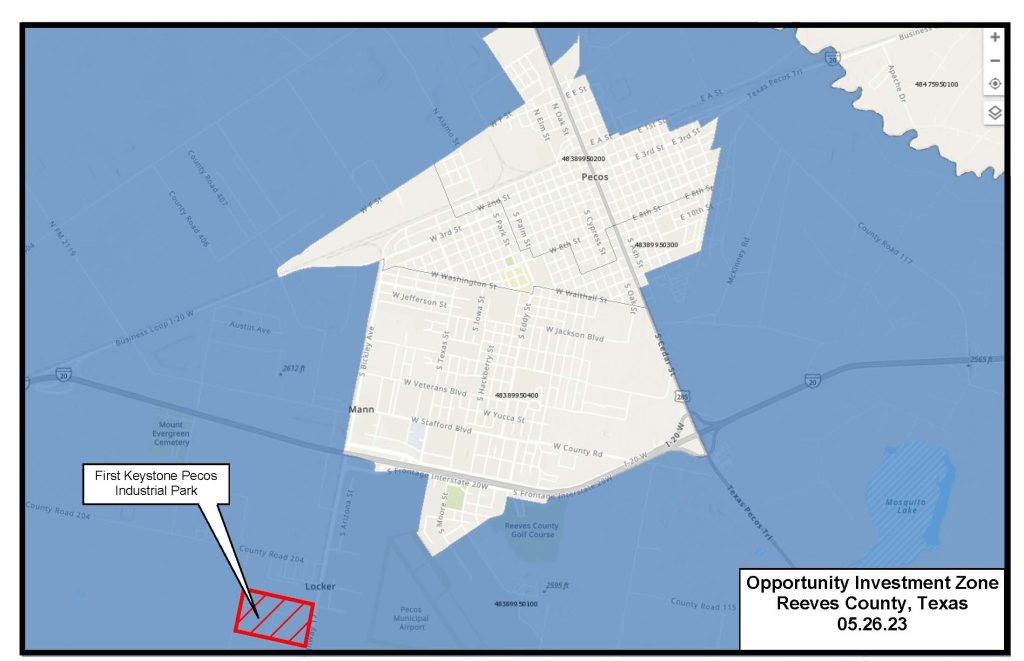

Accessing OIZ Assets in Pecos

First Keystone is the only Pecos-based developer of qualifying industrial assets that is willing and able to deliver such assets to end users or investors who seek to take advantage of this unusually generous tax provision.

Areas in blue on the map below are eligible for OIZ treatment.

The mechanics of complying are surprisingly benign. The program details can be found on the IRS website. Please contact us for additional detail.

Of course, this is a high-level overview of the QOZ program and we recommend any investor discuss the tax implications of pursuing a OIZ investment with their accountant or tax advisor.